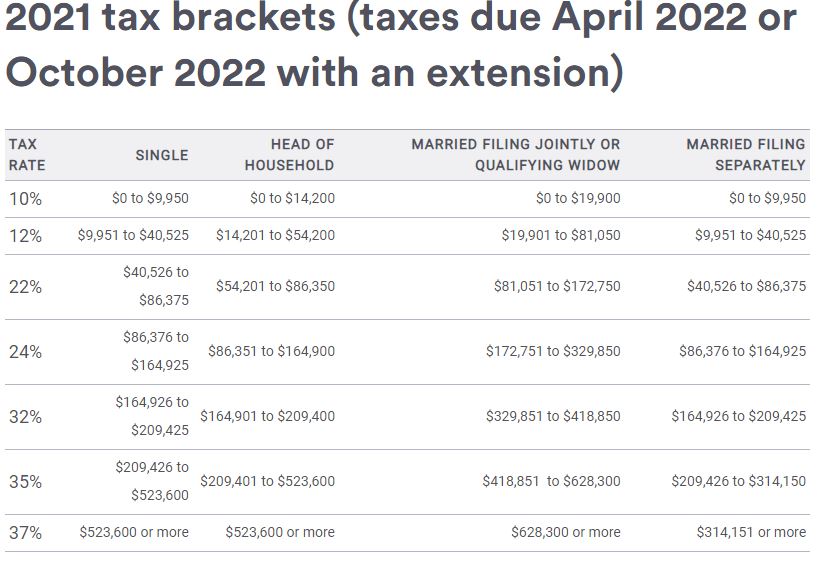

The kiddie tax applies to unearned income for children under the age of 19 and college students under the age of 24. Here’s what those numbers look like for 2021: The alternative minimum tax (AMT) exemption amounts are adjusted for inflation. Alternative Minimum Tax (AMT) Exemption Amounts The personal exemption amount remains zero under the Tax Cuts and Jobs Act (TCJA). There will be no personal exemption amount for 2021. It is cannot exceed the greater of $1,100 or the sum of $350 and the individual’s earned income (not to exceed the regular standard deduction amount). For 2021, the standard deduction amount for an individual who may be claimed as a dependent by another taxpayer remains the same.The additional standard deduction amount increases to $1,700 for unmarried taxpayers. For 2021, the additional standard deduction amount for the aged or the blind is $1,350.The standard deduction amounts will increase to $12,550 for individuals and married couples filing separately, $18,800 for heads of household, and $25,100 for married couples filing jointly and surviving spouses. For these rates to change, Congress would have to vote to change the tax rates. Note: These rates remain in place no matter what happens in November 2020. Here's how those break out by filing status: There are still seven (7) tax rates in 2021. If you plan to make more money or change your circumstances (for example, you’re getting married or starting a business), consider adjusting your withholding or tweaking your estimated tax payments. If you aren’t expecting any significant changes in 2021, you can use the updated numbers to estimate your liability. They are not the numbers and tables that you’ll use to prepare your 202o tax returns in 2021 ( you’ll find them here). These are the numbers that you’ll use to prepare your 2021 tax returns in 2022. These are the numbers for the tax year 2021 beginning January 1, 2021. The Internal Revenue Service (IRS) has announced the annual inflation adjustments for the tax year 2021, including tax rate schedules, tax tables and cost-of-living adjustments.

0 kommentar(er)

0 kommentar(er)